The Complete Guide to Automated Payment Capture on Landing Pages

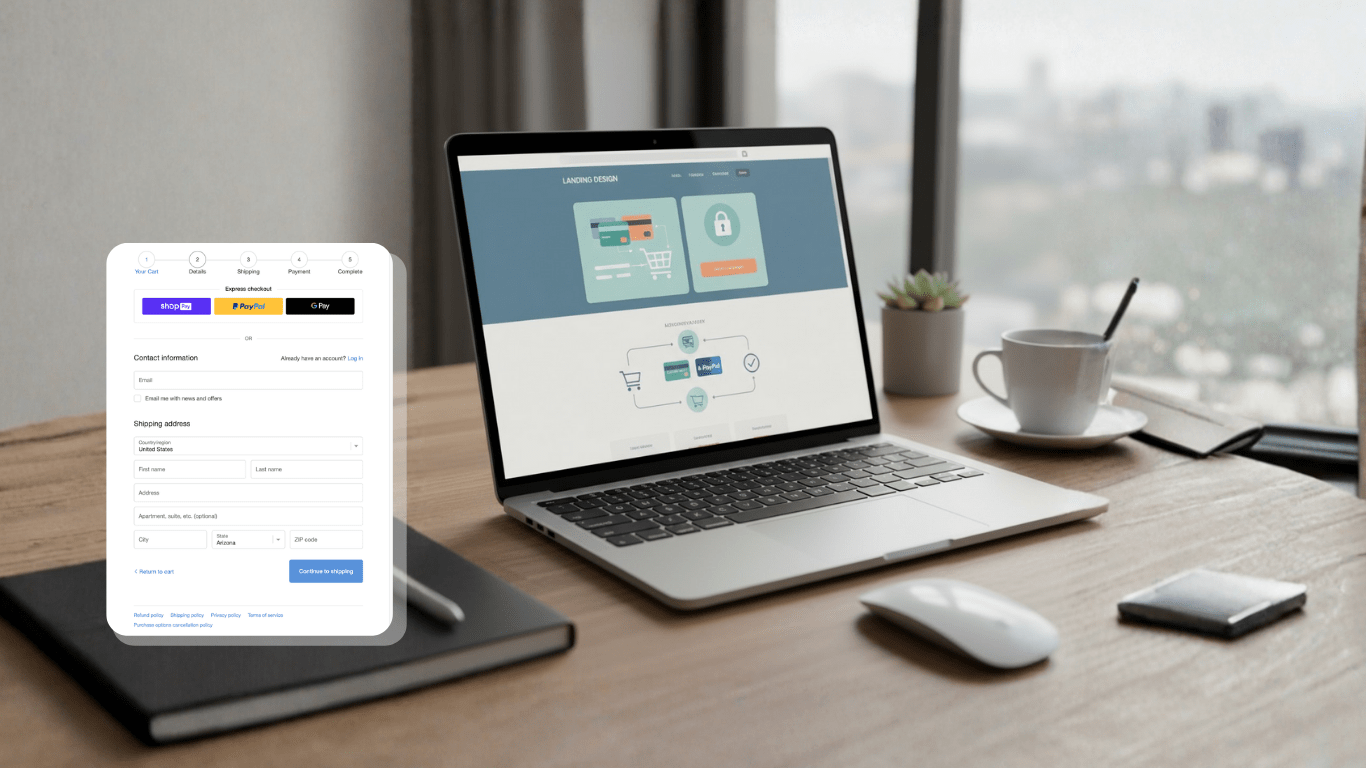

Setting up automated payment capture on your landing pages is one of the most critical steps in converting visitors into paying customers. Whether you’re selling digital products, services, or physical goods, a seamless payment experience can dramatically impact your conversion rates and revenue.

This comprehensive guide walks you through everything you need to know about implementing payment capture systems that work reliably, scale effortlessly, and provide the best experience for your customers.

Understanding Payment Capture: The Basics

Before diving into implementation, it’s essential to understand what automated payment capture actually means. At its core, payment capture is the process of securely collecting payment information from customers and processing those payments without manual intervention.

Modern payment systems handle multiple complex operations simultaneously: validating card information, checking for fraud, communicating with banks, managing currency conversions, handling declined transactions, and ensuring PCI compliance. All of this happens in seconds, behind the scenes.

The key word here is “automated.” Once properly configured, your payment system should work 24/7 without requiring your constant attention, allowing you to focus on growing your business rather than processing individual transactions.

Choosing Your Payment Gateway: The Foundation

Your payment gateway is the bridge between your landing page and the financial institutions that process payments. Selecting the right one depends on your business model, target audience, technical capabilities, and budget.

Stripe: The Developer Favorite

Stripe has become the gold standard for online payments, particularly for tech-savvy entrepreneurs and SaaS businesses. What makes Stripe exceptional is its developer-friendly approach, extensive documentation, and powerful API.

Official Website: stripe.com

Get Started: dashboard.stripe.com/register

Documentation: docs.stripe.com

Pricing Page: stripe.com/pricing

Pricing Structure:

- 2.9% + $0.30 per successful card charge (US domestic)

- 3.4% + $0.30 for manually-entered transactions

- 1% additional fee for international cards

- Currency conversion fee: 1% above wholesale exchange rates

Best For: SaaS products, subscription services, digital downloads, businesses requiring custom payment flows

Key Features:

- Stripe Checkout: Pre-built payment pages that handle the entire checkout flow

- Payment Links: Share payment URLs without building a website

- Stripe Elements: Customizable payment forms that embed directly in your page

- Robust subscription management

- Automatic retry logic for failed payments

- Built-in fraud detection (Stripe Radar)

- Support for 135+ currencies

Integration Complexity: Low to Medium. Stripe Checkout can be implemented in under an hour, while custom integrations using Stripe Elements require more development work.

PayPal: Maximum Trust and Reach

PayPal remains one of the most recognized payment brands globally. Many customers, particularly older demographics, feel more comfortable seeing the PayPal logo during checkout.

Official Website: paypal.com

Business Account Signup: paypal.com/business

Developer Portal: developer.paypal.com

Pricing Information: paypal.com/business/pricing

Pricing Structure:

- 3.49% + $0.49 per transaction (standard rate for goods and services)

- 2.99% + $0.49 for nonprofit organizations

- 3.99% + $0.49 for international transactions

- Additional fees for currency conversion (3-4%)

Best For: E-commerce stores, marketplaces, international sellers, businesses targeting audiences that prefer PayPal

Key Features:

- PayPal Checkout: One-click payment for PayPal users

- Guest checkout for credit card payments

- Buyer and seller protection programs

- Pay Later options (buy now, pay later financing)

- Extensive international reach in 200+ markets

Integration Complexity: Low. PayPal offers simple button integration and hosted checkout pages.

Square: Perfect for Physical-Digital Hybrids

Square excels when you need to accept payments both online and in person. If you have a brick-and-mortar presence alongside your online business, Square provides unified reporting and inventory management.

Official Website: squareup.com

Get Started: squareup.com/signup

Developer Documentation: developer.squareup.com

Pricing Details: squareup.com/pricing

Pricing Structure:

- 2.9% + $0.30 per online transaction

- 2.6% + $0.10 per in-person transaction (with Square reader)

- No monthly fees for basic accounts

Best For: Retail businesses with online presence, restaurants, service providers, businesses requiring in-person and online payments

Key Features:

- Free card readers for in-person payments

- Unified dashboard for all payment channels

- Built-in invoicing system

- Integration with Square POS system

- Same-day or next-day deposits available

Integration Complexity: Low. Square provides easy-to-use plugins and embedded forms.

Paddle: All-in-One for Digital Products

Paddle takes a different approach by acting as a merchant of record. This means Paddle handles not just payment processing but also sales tax, VAT, invoicing, and fraud prevention.

Official Website: paddle.com

Sign Up: paddle.com/signup

Documentation: developer.paddle.com

Pricing Information: paddle.com/pricing

Pricing Structure:

- 5% + $0.50 per transaction

- Higher fees, but includes tax handling and compliance

Best For: Software companies, SaaS businesses, digital product creators, businesses wanting to avoid tax compliance headaches

Key Features:

- Handles global tax compliance automatically

- Acts as merchant of record

- Built-in subscription management

- Dunning management for failed payments

- Complete revenue recovery system

Integration Complexity: Low to Medium. Paddle provides checkout overlays and embeddable forms.

Razorpay: Leading Choice for India and Southeast Asia

For businesses operating in India or targeting South Asian markets, Razorpay offers localized payment methods and competitive pricing.

Official Website: razorpay.com

Sign Up: dashboard.razorpay.com/signup

Developer Docs: razorpay.com/docs

Pricing Page: razorpay.com/pricing

Pricing Structure:

- 2% per transaction (domestic Indian cards)

- Additional fees for international cards and UPI payments

- No setup or annual maintenance fees

Best For: Indian businesses, companies targeting Indian consumers, businesses needing UPI integration

Key Features:

- Support for UPI, net banking, wallets, and cards

- Automated payment routing for higher success rates

- Local currency support

- Subscription billing

- Instant settlements available

Integration Complexity: Low to Medium. Well-documented API and multiple integration options.

Setting Up Your Payment Infrastructure: Step-by-Step

Now that you understand your options, let’s walk through the actual setup process. I’ll use Stripe as the primary example since it’s widely applicable, but the principles apply to most gateways.

Phase 1: Account Creation and Verification

Your first step is creating an account with your chosen payment provider. This process typically involves:

Business Information Requirements:

- Legal business name and structure

- Tax identification number (EIN or SSN)

- Bank account details for receiving payments

- Business address and contact information

- Website or app details

- Description of products or services

Most providers require identity verification to comply with financial regulations. You’ll need to provide government-issued ID, and some may request additional documentation like articles of incorporation or business licenses.

Timeline: Account approval typically takes 1-3 business days, though you can often test in sandbox mode immediately.

Phase 2: Configuring Your Payment Settings

Before integrating payments into your landing page, configure your account settings properly:

Currency Settings: Determine which currencies you’ll accept. If selling internationally, consider enabling multiple currency support to reduce conversion friction for customers.

Payout Schedule: Configure how frequently funds transfer to your bank account. Options typically include daily, weekly, or monthly transfers. Faster payouts may incur additional fees.

Receipt Configuration: Customize the email receipts customers receive. Include your branding, support information, and relevant legal disclaimers.

Tax Settings: Configure sales tax collection if required in your jurisdiction. Many payment processors now offer automatic tax calculation and collection.

Fraud Prevention: Enable fraud detection tools. Stripe Radar, for example, uses machine learning to identify suspicious transactions. Set rules for declining high-risk payments automatically.

Phase 3: Integration Methods Explained

You have several approaches to integrating payment capture, each with different complexity levels and customization options.

Option 1: Hosted Checkout Pages (Easiest)

Hosted checkout pages are pre-built payment forms hosted by your payment provider. When customers click “Buy Now,” they’re redirected to a secure payment page, complete the transaction, then return to your site.

Stripe Checkout Implementation:

Create a payment link in your Stripe dashboard:

- Navigate to Payment Links in your Stripe dashboard

- Click “Create payment link”

- Add product details (name, price, description, images)

- Configure payment options (one-time or recurring)

- Set success and cancellation URLs

- Generate the link

You receive a URL like buy.stripe.com/your-unique-link that you can add to any button on your landing page.

Pros:

- No coding required

- PCI compliance handled automatically

- Mobile-optimized by default

- Supports multiple payment methods

- Quick setup (minutes, not hours)

Cons:

- Less control over design and user experience

- Customer leaves your website during checkout

- Limited customization options

Option 2: Embedded Checkout Forms (Moderate)

Embedded forms display payment fields directly on your landing page while remaining secure and PCI-compliant. The payment gateway provides JavaScript code that renders the form in an iframe.

Implementation Example with Stripe Elements:

<!-- Add Stripe.js library -->

<script src="https://js.stripe.com/v3/"></script>

<!-- Create payment form container -->

<form id="payment-form">

<div id="card-element"></div>

<button id="submit-button">Pay $99</button>

<div id="error-message"></div>

</form>

<script>

// Initialize Stripe

const stripe = Stripe('your_publishable_key');

const elements = stripe.elements();

const cardElement = elements.create('card');

cardElement.mount('#card-element');

// Handle form submission

const form = document.getElementById('payment-form');

form.addEventListener('submit', async (event) => {

event.preventDefault();

const {error, paymentMethod} = await stripe.createPaymentMethod({

type: 'card',

card: cardElement,

});

if (error) {

document.getElementById('error-message').textContent = error.message;

} else {

// Send paymentMethod.id to your server

handleServerSidePayment(paymentMethod.id);

}

});

</script>

This approach requires server-side code to complete the payment. You’d need a backend endpoint that receives the payment method ID and creates a charge:

// Server-side example (Node.js)

const stripe = require('stripe')('your_secret_key');

app.post('/create-payment', async (req, res) => {

const { paymentMethodId, amount } = req.body;

try {

const paymentIntent = await stripe.paymentIntents.create({

amount: amount,

currency: 'usd',

payment_method: paymentMethodId,

confirm: true,

});

res.json({ success: true, paymentIntent });

} catch (error) {

res.json({ error: error.message });

}

});

Pros:

- Seamless user experience (no redirect)

- More control over styling and flow

- Better conversion rates

- Professional appearance

Cons:

- Requires coding knowledge

- More complex setup

- Need to maintain server infrastructure

Option 3: No-Code Tools Integration (Easiest for Non-Developers)

If you’re building landing pages with tools like Webflow, Carrd, WordPress, or Unbounce, many offer native payment integrations or plugins.

Webflow + Stripe Example:

- Install the Stripe app from Webflow’s marketplace

- Connect your Stripe account

- Add a “Buy Button” element to your page

- Configure product details in the Webflow designer

- Style the button to match your brand

- Publish your site

WordPress + WooCommerce:

- Install WooCommerce plugin

- Install Stripe payment gateway extension

- Enter your Stripe API keys in WooCommerce settings

- Configure product pages

- Embed products using shortcodes or blocks

Pros:

- No coding required

- Visual interface for configuration

- Quick setup

- Maintained and updated automatically

Cons:

- Limited to platform capabilities

- May require platform-specific subscription

- Less flexibility for custom workflows

Phase 4: Implementing Subscription Payments

If your business model includes recurring revenue, you’ll need to configure subscription billing. This is more complex than one-time payments but extremely powerful.

Key Subscription Components:

Billing Intervals: Define how often customers are charged (weekly, monthly, quarterly, annually). Most businesses offer multiple tiers with different intervals.

Trial Periods: Offer free trials to reduce friction. You can collect payment information upfront but delay the first charge. Configure trial length (7 days, 14 days, 30 days are common).

Metered Billing: For usage-based pricing, set up metered billing that charges based on consumption rather than flat rates.

Failed Payment Handling: Configure retry logic for failed subscription payments. Best practice is attempting 3-4 retries over 2 weeks before canceling the subscription.

Dunning Management: Set up automated emails to customers when payments fail, prompting them to update their payment method.

Stripe Subscription Setup:

- Create products and pricing plans in your Stripe dashboard

- Use Stripe Checkout configured for subscriptions

- Implement webhook handlers for subscription events (created, updated, canceled, payment failed)

- Build customer portal where users can manage their subscriptions

// Creating a subscription

const subscription = await stripe.subscriptions.create({

customer: customerId,

items: [{ price: 'price_monthly_plan' }],

trial_period_days: 14,

payment_behavior: 'default_incomplete',

expand: ['latest_invoice.payment_intent'],

});

Phase 5: Security and Compliance

Payment security isn’t optional—it’s legally required and essential for customer trust.

PCI DSS Compliance: The Payment Card Industry Data Security Standard (PCI DSS) defines security requirements for handling card data. When using hosted solutions like Stripe Checkout, PayPal, or embedded forms, you benefit from their PCI compliance. Your responsibility level depends on your integration method:

- SAQ A: For hosted payment pages (least responsibility)

- SAQ A-EP: For embedded JavaScript forms

- SAQ D: For direct card data handling (most responsibility)

For most landing pages using modern payment APIs, you’ll qualify for SAQ A, which involves a simple questionnaire and no third-party audit.

SSL Certificates: Your landing page must use HTTPS. Browsers now warn users about insecure pages, and payment providers require SSL for processing payments. Obtain SSL certificates from your hosting provider or services like Let’s Encrypt (free).

Data Handling: Never store sensitive payment data on your servers unless you’re fully PCI compliant. Use tokenization—payment providers create secure tokens representing card data that you can safely store and reference.

3D Secure Authentication: Enable Strong Customer Authentication (SCA) for European customers. This adds an extra verification step (typically biometric or SMS code) for certain transactions. Modern payment APIs handle this automatically.

Phase 6: Testing Your Payment Flow

Before launching, thoroughly test your payment integration to catch issues that could cost you sales.

Test Mode Setup: Every major payment provider offers test mode with fake card numbers:

Stripe Test Cards:

- Success: 4242 4242 4242 4242

- Declined: 4000 0000 0000 0002

- Insufficient funds: 4000 0000 0000 9995

- 3D Secure required: 4000 0027 6000 3184

Use any future expiration date and any 3-digit CVC.

Testing Checklist:

- Successful payment processing

- Declined card handling

- Expired card detection

- Insufficient funds scenarios

- 3D Secure authentication flow

- Subscription creation and renewal

- Trial period expiration

- Failed payment retries

- Refund processing

- Different payment methods (if multiple enabled)

- Mobile device testing

- Multiple browsers

- Loading states and error messages

- Receipt email delivery

- Webhook reliability

Load Testing: If expecting high traffic, test how your payment system handles concurrent transactions. Services like LoadImpact can simulate hundreds of simultaneous payments.

Phase 7: Webhooks and Post-Payment Actions

Webhooks allow your landing page to respond automatically to payment events. This is crucial for delivering digital products, sending welcome emails, or updating your database.

Common Webhook Events:

payment_intent.succeeded– Payment completed successfullypayment_intent.failed– Payment failedcustomer.subscription.created– New subscription startedcustomer.subscription.deleted– Subscription canceledinvoice.payment_failed– Subscription payment failed

Setting Up Webhooks:

- Create an endpoint on your server to receive webhook data

- Register the endpoint URL in your payment provider’s dashboard

- Verify webhook signatures to ensure authenticity

- Process events idempotently (handle duplicate notifications)

- Return 200 OK status quickly (process in background if needed)

Example Webhook Handler:

app.post('/webhook', express.raw({type: 'application/json'}), (req, res) => {

const sig = req.headers['stripe-signature'];

let event;

try {

event = stripe.webhooks.constructEvent(req.body, sig, webhookSecret);

} catch (err) {

return res.status(400).send(`Webhook Error: ${err.message}`);

}

// Handle different event types

switch (event.type) {

case 'payment_intent.succeeded':

const paymentIntent = event.data.object;

// Fulfill the order, send product, update database

fulfillOrder(paymentIntent);

break;

case 'customer.subscription.created':

// Send welcome email, grant access

provisionSubscription(event.data.object);

break;

}

res.json({received: true});

});

Optimizing for Conversions

Technical implementation is only half the battle. Optimizing your payment flow for maximum conversions requires attention to user experience.

Reduce Form Fields: Every additional field decreases conversion. Use autofill, address lookup APIs, and smart defaults to minimize typing.

Trust Signals: Display security badges, SSL indicators, money-back guarantees, and customer testimonials near your payment form.

Multiple Payment Options: Offer credit cards, PayPal, Apple Pay, Google Pay, and regional payment methods. Each additional option increases conversion by 5-10%.

Clear Pricing: Display total cost including taxes and fees before the payment screen. Surprise costs are the number one reason for cart abandonment.

Mobile Optimization: Over 50% of transactions now occur on mobile devices. Test your payment flow extensively on phones and tablets. Use large touch targets and mobile-optimized keyboards.

Progress Indicators: For multi-step checkouts, show customers where they are in the process. Uncertainty causes abandonment.

Error Handling: Provide specific, helpful error messages. Instead of “Payment failed,” explain “Your card was declined. Please check the card number and try again, or use a different payment method.”

Loading States: Show clear feedback during payment processing. Use spinner animations and messages like “Processing your payment…” Never leave customers wondering if something is happening.

Advanced Features and Optimization

Once your basic payment capture is working, consider these advanced features to increase revenue and reduce friction.

One-Click Upsells: After successful payment, immediately offer complementary products. Since payment information is already collected, customers can add items with one click. This can increase average order value by 30-40%.

Save Payment Methods: Allow customers to save cards for faster future purchases. Stripe’s Setup Intents make this secure and PCI-compliant.

Dynamic Pricing: Adjust prices based on customer location, device type, or marketing campaign. Use Stripe’s Price IDs to create multiple pricing configurations.

Abandoned Cart Recovery: For checkout flows with email collection before payment, send automated emails to customers who don’t complete their purchase. Include a direct link to resume checkout.

Payment Method Diversity: Beyond credit cards, consider:

- Bank debits (ACH in US, SEPA in Europe)

- Digital wallets (Apple Pay, Google Pay, PayPal)

- Buy now, pay later (Klarna, Affirm, Afterpay)

- Cryptocurrency (if appropriate for your audience)

- Regional methods (iDEAL in Netherlands, Alipay in China)

Smart Retries: For subscription businesses, implement intelligent retry logic that attempts to charge failed payments at optimal times (early morning, after payday, etc.).

Revenue Recovery: Use services like Stripe’s Smart Retries and Adaptive Acceptance to automatically recover failed payments through alternative routing and retry timing.

Monitoring and Analytics

What gets measured gets improved. Track these key metrics to optimize your payment flow:

Conversion Rate: Percentage of visitors who complete payment. Industry average is 2-3% for cold traffic, 20-30% for warm traffic.

Payment Success Rate: Percentage of attempted payments that succeed. Should be above 95%. Lower rates indicate fraud filters that are too strict or technical issues.

Average Order Value: Track over time and across traffic sources. Test pricing strategies and upsells to increase this metric.

Revenue by Payment Method: Understand which payment options generate the most revenue. Prioritize optimizing these methods.

Failed Payment Reasons: Most payment providers categorize declines (insufficient funds, fraud, technical error). Understanding why payments fail helps you address issues.

Checkout Abandonment Rate: Percentage of people who start checkout but don’t complete payment. High rates indicate friction in your flow.

Mobile vs Desktop Conversion: Compare conversion rates across devices. Often mobile converts lower and requires specific optimization.

Use Analytics Tools:

- Google Analytics Enhanced Ecommerce

- Payment provider dashboards (Stripe Dashboard, PayPal Analytics)

- Heatmapping tools (Hotjar, Crazy Egg) to see where users click and scroll

- Session recording tools to watch user behavior

Legal Considerations and Best Practices

Operating a payment business comes with legal responsibilities. Consult with legal professionals, but here are key considerations:

Terms of Service: Clearly state your refund policy, delivery timeline, and product descriptions. Make terms easily accessible and require acceptance before payment.

Privacy Policy: Explain how you collect, use, and protect customer data. This is required by GDPR, CCPA, and other privacy regulations.

Sales Tax: Determine nexus (where you’re required to collect sales tax). Tools like Stripe Tax or TaxJar can automate this.

Refund Policy: Clearly communicate your refund terms. Process refunds promptly—it builds trust and reduces chargebacks.

Chargeback Management: When customers dispute charges with their bank, you face chargebacks. Maintain detailed records, provide excellent customer service, and respond quickly to disputes. High chargeback rates (>1%) can result in account termination.

Anti-Money Laundering: Payment providers monitor for suspicious activity. Unusual patterns may trigger account reviews. Maintain legitimate business practices and transparent operations.

International Regulations: If selling internationally, understand VAT (Europe), GST (Australia, India, Singapore), and other tax requirements. Paddle and Stripe Tax can help manage this complexity.

Common Mistakes to Avoid

Learn from others’ errors:

Mistake 1: No Test Transactions: Always test before launching. A broken payment flow means zero revenue.

Mistake 2: Ignoring Mobile: Over half your customers are on mobile. A desktop-only optimized flow loses sales.

Mistake 3: Complicated Checkout: Each additional step or field reduces conversion by 10-15%. Ruthlessly simplify.

Mistake 4: Hidden Fees: Surprise charges at checkout cause abandonment and damage trust. Show full costs upfront.

Mistake 5: Poor Error Messages: Generic errors frustrate customers. Provide specific, actionable guidance when payments fail.

Mistake 6: No Webhook Handling: Without webhooks, you can’t automate product delivery or handle subscription events. Implement from day one.

Mistake 7: Weak Security: SSL certificates, fraud detection, and proper data handling aren’t optional. Security failures can destroy your business.

Mistake 8: Single Payment Method: Customers have preferences. Offering only credit cards excludes PayPal users, mobile wallet users, and international customers.

Mistake 9: No Customer Support: Payment issues happen. Provide clear contact information and respond quickly to payment questions.

Mistake 10: Ignoring Analytics: You can’t optimize what you don’t measure. Track key metrics from day one.

Conclusion: Your Path Forward

Setting up automated payment capture on landing pages has never been more accessible. Modern payment platforms have abstracted away most of the complexity, allowing entrepreneurs to accept payments globally with minimal technical expertise.

Start simple: Choose a payment provider that matches your business model (Stripe for flexibility, PayPal for trust, Square for physical-digital hybrid, Paddle for simplified tax compliance). Use their hosted checkout solution to launch quickly. As you scale, implement embedded forms for better conversion rates and add advanced features like subscriptions and one-click upsells.

The most important step is starting. A landing page without payment capture is just a business card. With payment capture, it becomes a revenue-generating asset working for you 24/7.

Test thoroughly, monitor your metrics, iterate based on data, and always prioritize your customer’s experience. The easier you make it for people to give you money, the more money they’ll give you.

Now stop reading and start building. Your first automated payment is waiting to happen.

Essential Resources & Links

Payment Gateway Providers

Stripe

- Website: stripe.com

- Sign Up: dashboard.stripe.com/register

- Documentation: docs.stripe.com

- Pricing: stripe.com/pricing

- Support: support.stripe.com

PayPal

- Website: paypal.com

- Business Account: paypal.com/business

- Developer Portal: developer.paypal.com

- Pricing: paypal.com/business/pricing

- Help Center: paypal.com/help

Square

- Website: squareup.com

- Get Started: squareup.com/signup

- Developer Docs: developer.squareup.com

- Pricing: squareup.com/pricing

- Support: squareup.com/help

Paddle

- Website: paddle.com

- Sign Up: paddle.com/signup

- Developer Portal: developer.paddle.com

- Pricing: paddle.com/pricing

- Support: paddle.com/support

Razorpay

- Website: razorpay.com

- Sign Up: dashboard.razorpay.com/signup

- Documentation: razorpay.com/docs

- Pricing: razorpay.com/pricing

- Support: razorpay.com/support

Additional Payment Options

Braintree (PayPal Company)

- Website: braintreepayments.com

- Good for: High-volume merchants, marketplaces

Authorize.Net

- Website: authorize.net

- Good for: Established businesses, traditional merchants

2Checkout (Verifone)

- Website: 2checkout.com

- Good for: International businesses, digital goods

Mollie

- Website: mollie.com

- Good for: European businesses, local payment methods

Adyen

- Website: adyen.com

- Good for: Enterprise businesses, global commerce

Alternative Payment Methods

Apple Pay

- Integration Guide: developer.apple.com/apple-pay

Google Pay

- Integration Guide: developers.google.com/pay

Buy Now, Pay Later

- Klarna: klarna.com/business

- Affirm: affirm.com/business

- Afterpay: afterpay.com/business

No-Code Landing Page Builders with Payment Integration

Webflow

- Website: webflow.com

- Ecommerce: webflow.com/ecommerce

Carrd

- Website: carrd.co

- Payment Forms: Built-in PayPal and Stripe support

WordPress + WooCommerce

- WordPress: wordpress.org

- WooCommerce: woocommerce.com

Shopify

- Website: shopify.com

- Landing Pages: shopify.com/online

Gumroad

- Website: gumroad.com

- Good for: Digital products, creators

ThriveCart

- Website: thrivecart.com

- Good for: Cart and checkout optimization

Security & Compliance Resources

PCI Security Standards

- Website: pcisecuritystandards.org

- Self-Assessment: pcisecuritystandards.org/document_library

SSL Certificates

- Let’s Encrypt (Free): letsencrypt.org

- Cloudflare SSL: cloudflare.com/ssl

Fraud Prevention

- Stripe Radar: stripe.com/radar

- Signifyd: signifyd.com

- Sift: sift.com

Tax Compliance Tools

Stripe Tax

- Website: stripe.com/tax

TaxJar

- Website: taxjar.com

Avalara

- Website: avalara.com

Quaderno

- Website: quaderno.io

Analytics & Optimization

Google Analytics

- Website: analytics.google.com

- Enhanced Ecommerce: support.google.com/analytics

Hotjar

- Website: hotjar.com

- Good for: Heatmaps and session recordings

Crazy Egg

- Website: crazyegg.com

- Good for: A/B testing and heatmaps

Learning Resources

Stripe Documentation

- Payment Integration Guide: docs.stripe.com/payments

- Video Tutorials: youtube.com/@stripe

PayPal Developer Resources

- Integration Tutorials: developer.paypal.com/docs

Industry Blogs

- Stripe Blog: stripe.com/blog

- PayPal Stories: paypal.com/stories

- Payment processing news: pymnts.com

Community Support

Stack Overflow

- Stripe Tag: stackoverflow.com/questions/tagged/stripe-payments

- PayPal Tag: stackoverflow.com/questions/tagged/paypal

Reddit Communities

- r/ecommerce: reddit.com/r/ecommerce

- r/Entrepreneur: reddit.com/r/Entrepreneur

- r/SaaS: reddit.com/r/SaaS

Testing Tools

Stripe Testing

- Test Card Numbers: docs.stripe.com/testing

Load Testing

- K6: k6.io

- LoadImpact: loadimpact.com

Bookmark this guide and refer back as you build and optimize your payment capture system. Each link has been verified to ensure you have access to the most current and accurate information from official sources.

Next Steps:

- Choose your payment provider based on your business needs

- Sign up for a test account

- Follow the implementation steps in this guide

- Test thoroughly before going live

- Monitor your metrics and iterate

Good luck with your payment integration! 🚀